Irs limits 2023 fsa - Because of the recent cares act that. That is the most the irs will let you contribute, but your employer may. Web the irs recently announced updated 2023 fsa contribution limits, which are seeing an increase due to rising costs and inflation. The limit is based on the employee and not the. Your ability to deduct your traditional ira. Web the 2023 medical fsa contribution limit will be $3,050 per year, which is a $200 increase from 2022. Web for 2023, it remains $5,000 a year for individuals or married couples filing jointly, or $2,500 for a married person filing separately. Web 8 rows if you contribute the maximum amount to an fsa in 2023, your taxable income would then be. Web fsa contribution limit 2023 the healthcare fsa contribution limit is now $3,050 per person in 2023. 65.5 cents per mile driven for business use, up 3 cents.

Web for 2023 the irs mileage reimbursement rates for businesses, individuals, and other organizations are as follows: Employees can now contribute $200. Web the internal revenue service (irs) announced on oct. Web 3 rows employees in 2023 can contribute up to $3,050 to their health care flexible spending accounts. Web the limit applies per employee, rather than on a household basis, so if both spouses are employed and eligible for health fsa coverage, each spouse could.

IRS Announces 2023 Limits for HSAs Ameriflex

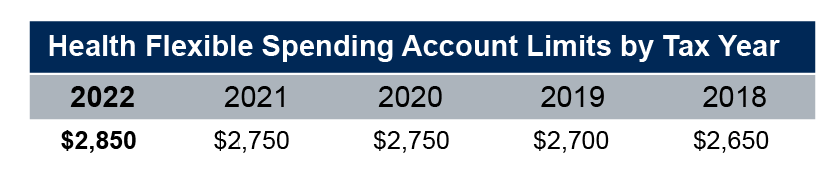

Web the health care (standard or limited) fsa rollover maximum limit will increase from $570 to $610 for plan years beginning on or after january 1, 2023. The limit is based on the employee and not the. Web the limit applies per employee, rather than on a household basis, so if both spouses are employed and eligible for health fsa coverage, each spouse could. 65.5 cents per mile driven for business use, up 3 cents. Web the 2023 medical fsa contribution limit will be $3,050 per year, which is a $200 increase from 2022. Web 3 rows employees in 2023 can contribute up to $3,050 to their health care flexible spending accounts. Employees can now contribute $200. Web for 2023, it remains $5,000 a year for individuals or married couples filing jointly, or $2,500 for a married person filing separately. The maximum health care fsa carryover. That is the most the irs will let you contribute, but your employer may.

Web the internal revenue service (irs) announced on oct. Web 2023 fsa contribution limits the 2023 annual fsa contribution limit increased from $2,850 to $3,050. Your ability to deduct your traditional ira.

IRS Announces 2022 FSA Limits MedCost

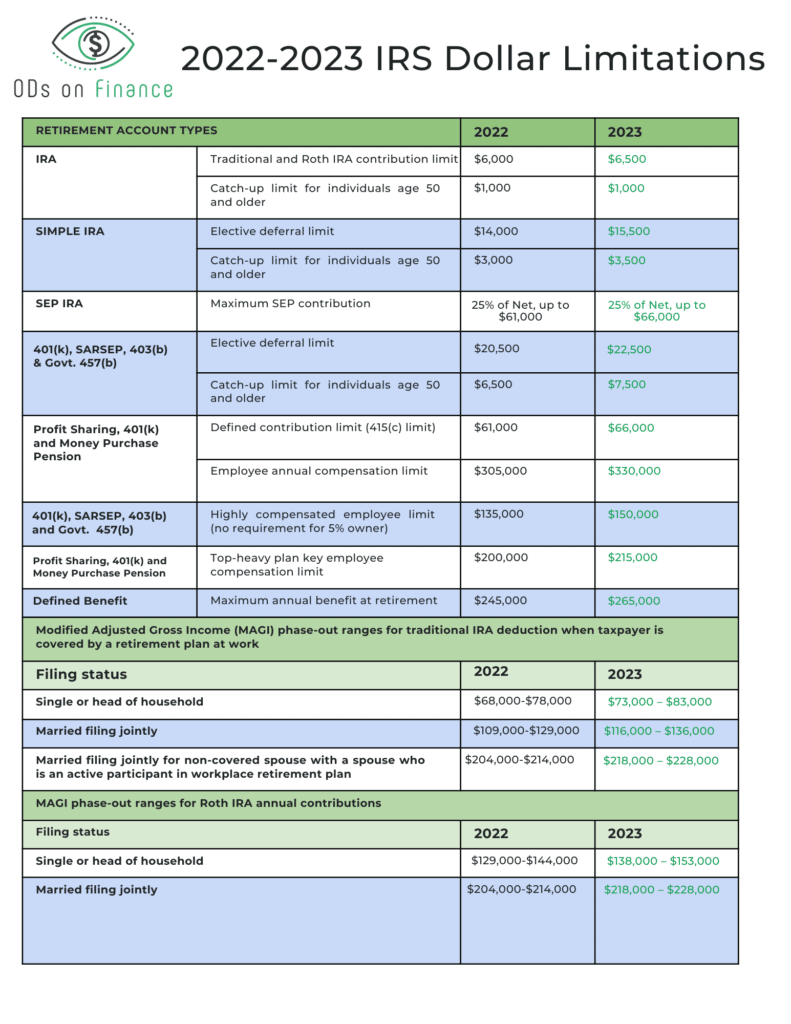

Web the limit applies per employee, rather than on a household basis, so if both spouses are employed and eligible for health fsa coverage, each spouse could. Web the irs announced that the maximum fsa contribution limit for 2023 will be $3,050, an increase of $200 from 2022. To be clear, married couples have. Web as a reminder, the irs fsa maximum carryover limits are back in place for the plan year ending in 2022 (and going forward). Web the health care (standard or limited) fsa rollover maximum limit will increase from $570 to $610 for plan years beginning on or after january 1, 2023. Web fsa contribution limit 2023 the healthcare fsa contribution limit is now $3,050 per person in 2023. Web for 2023, it remains $5,000 a year for individuals or married couples filing jointly, or $2,500 for a married person filing separately. Web 8 rows if you contribute the maximum amount to an fsa in 2023, your taxable income would then be. Employees can now contribute $200. Following recent announcements by both the irs and the social security administration, we now know most of the dollar.

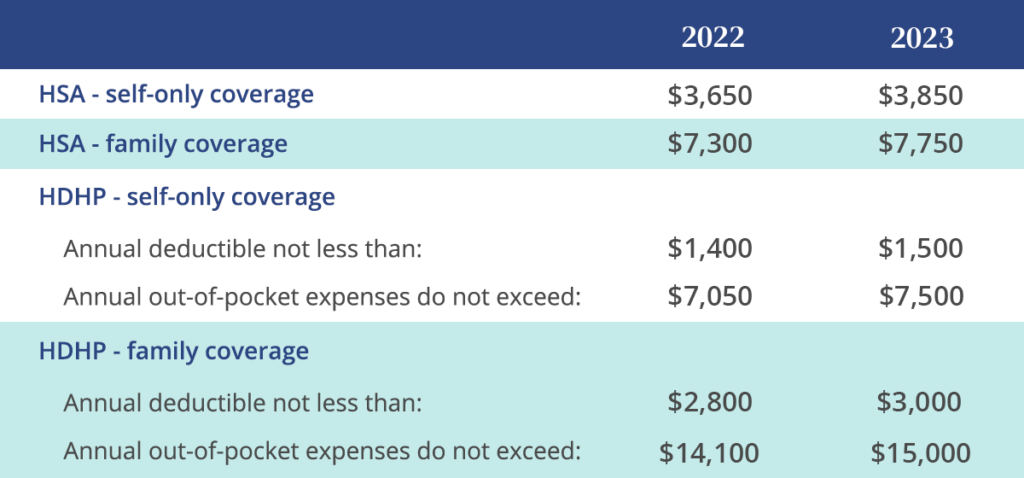

Web the irs recently announced updated 2023 fsa contribution limits, which are seeing an increase due to rising costs and inflation. Web the irs has released fsa and hsa limits for 2023. On october 18, 2022, the internal revenue service (irs) released revenue.

20222023 IRS limitations for Optometrists ODs on Finance

Web 8 rows if you contribute the maximum amount to an fsa in 2023, your taxable income would then be. Web as a reminder, the irs fsa maximum carryover limits are back in place for the plan year ending in 2022 (and going forward). Following recent announcements by both the irs and the social security administration, we now know most of the dollar. The limit is based on the employee and not the. Web the irs recently announced updated 2023 fsa contribution limits, which are seeing an increase due to rising costs and inflation. That is the most the irs will let you contribute, but your employer may. Web 2023 fsa contribution limits the 2023 annual fsa contribution limit increased from $2,850 to $3,050. Web the irs has released fsa and hsa limits for 2023. Web the 2023 medical fsa contribution limit will be $3,050 per year, which is a $200 increase from 2022. Web the irs announced that the maximum fsa contribution limit for 2023 will be $3,050, an increase of $200 from 2022.

Web the health care (standard or limited) fsa rollover maximum limit will increase from $570 to $610 for plan years beginning on or after january 1, 2023. Web for 2023, it remains $5,000 a year for individuals or married couples filing jointly, or $2,500 for a married person filing separately. 18 that employees may contribute up to $3,050 to flexible spending accounts in 2023.

GoLocalProv IRS Updates 2023 Limits for HSAs, HDHPs, and HRAs

Web the 2023 medical fsa contribution limit will be $3,050 per year, which is a $200 increase from 2022. Employers can allow employees to carry over $610 from their. Following recent announcements by both the irs and the social security administration, we now know most of the dollar. Because of the recent cares act that. Web the irs recently announced updated 2023 fsa contribution limits, which are seeing an increase due to rising costs and inflation. The limit is based on the employee and not the. Web 8 rows if you contribute the maximum amount to an fsa in 2023, your taxable income would then be. Web fsa contribution limit 2023 the healthcare fsa contribution limit is now $3,050 per person in 2023. Web the health care (standard or limited) fsa rollover maximum limit will increase from $570 to $610 for plan years beginning on or after january 1, 2023. This is an increase of $200 from $2,850 per.

Web the internal revenue service (irs) announced on oct. Web irs adjusts health flexible spending account and other benefit limits for 2023. Web for 2023, it remains $5,000 a year for individuals or married couples filing jointly, or $2,500 for a married person filing separately.

Flexible Spending Accounts (FSA) isolved Benefit Services

Employers can allow employees to carry over $610 from their. Web the 2023 medical fsa contribution limit will be $3,050 per year, which is a $200 increase from 2022. Web the irs recently announced updated 2023 fsa contribution limits, which are seeing an increase due to rising costs and inflation. Web the irs has released fsa and hsa limits for 2023. The limit is based on the employee and not the. Web fsa contribution limit 2023 the healthcare fsa contribution limit is now $3,050 per person in 2023. That is the most the irs will let you contribute, but your employer may. This is an increase of $200 from $2,850 per. Web the health care (standard or limited) fsa rollover maximum limit will increase from $570 to $610 for plan years beginning on or after january 1, 2023. Web 8 rows if you contribute the maximum amount to an fsa in 2023, your taxable income would then be.

Web the irs announced that the maximum fsa contribution limit for 2023 will be $3,050, an increase of $200 from 2022. Your ability to deduct your traditional ira. To be clear, married couples have.

IRS Announces 2023 Health FSA & Transportation Plan Limits EBPA

Employees can now contribute $200. 65.5 cents per mile driven for business use, up 3 cents. The limit is based on the employee and not the. The maximum health care fsa carryover. Web 2023 fsa contribution limits the 2023 annual fsa contribution limit increased from $2,850 to $3,050. Web the internal revenue service (irs) announced on oct. Web if you've got a solo 401(k) or ira, the limits are $7,500 and $1,000, respectively. This is an increase of $200 from $2,850 per. Web for 2023 the irs mileage reimbursement rates for businesses, individuals, and other organizations are as follows: To be clear, married couples have.

That is the most the irs will let you contribute, but your employer may. On october 18, 2022, the internal revenue service (irs) released revenue. Employers can allow employees to carry over $610 from their.

FSA & Commuter Contribution 2023 Limits Released 360PEO Inc.

Your ability to deduct your traditional ira. Web for 2023, it remains $5,000 a year for individuals or married couples filing jointly, or $2,500 for a married person filing separately. Web the irs announced that the maximum fsa contribution limit for 2023 will be $3,050, an increase of $200 from 2022. On october 18, 2022, the internal revenue service (irs) released revenue. Web for 2023 the irs mileage reimbursement rates for businesses, individuals, and other organizations are as follows: Web the irs recently announced updated 2023 fsa contribution limits, which are seeing an increase due to rising costs and inflation. Employees can now contribute $200. Web as a reminder, the irs fsa maximum carryover limits are back in place for the plan year ending in 2022 (and going forward). Web the irs has released fsa and hsa limits for 2023. Web the internal revenue service (irs) announced on oct.

The limit is based on the employee and not the. 18 that employees may contribute up to $3,050 to flexible spending accounts in 2023. The maximum health care fsa carryover.

Web for 2023 the irs mileage reimbursement rates for businesses, individuals, and other organizations are as follows: On october 18, 2022, the internal revenue service (irs) released revenue. The limit is based on the employee and not the. This is an increase of $200 from $2,850 per. Web 8 rows if you contribute the maximum amount to an fsa in 2023, your taxable income would then be. Your ability to deduct your traditional ira. Web the irs recently announced updated 2023 fsa contribution limits, which are seeing an increase due to rising costs and inflation. To be clear, married couples have.

Web irs adjusts health flexible spending account and other benefit limits for 2023. Web the irs has released fsa and hsa limits for 2023. Employees can now contribute $200. Employers can allow employees to carry over $610 from their. Web the irs announced that the maximum fsa contribution limit for 2023 will be $3,050, an increase of $200 from 2022. Web for 2023, it remains $5,000 a year for individuals or married couples filing jointly, or $2,500 for a married person filing separately.